AMERICAN INTEGRITY STANDS READY TO ASSIST IMPACTED POLICYHOLDERS

American Integrity Insurance is here to help our policyholders who have been affected by Hurricane Nicole. Our thoughts are with all Floridians who were impacted by the storm. Your family’s safety and recovery is our highest priority.

If you have experienced damage to your home, please contact us as soon as possible so that we can help you begin to get your life and home back in order.

We are here for you.

TO FILE A CLAIM

BY PHONE OR ONLINE - For tropical storm or hurricane-related claims, please contact us as soon as possible at 844-MyAIIC1, or go to our Claims Portal to file a claim online and check the status of your claim.

When filing a claim, please have the following information available:

- Your contact information

- Photos of the damages right after the loss

- Invoices for any temporary repairs or mechanical parts

- Receipts and invoices for incurred expenses if your home is deemed unlivable. Please note that coverage for these expenses is known as Additional Living Expenses (ALE). Be sure to ask your claims representative if ALE is included in your policy.

After a storm, be extremely vigilant of fraudulent contractors who prey on homeowners simply trying to get their lives and homes back to normal. Read all paperwork carefully and ask for recommendations and credentials when selecting a contractor.

While our goal is to assist all customers in a timely manner, it’s important to remember that, after a storm, we respond to claims based on severity. After helping customers who have been displaced from their homes, our adjusters will reach out to policyholders based on the level of damage sustained by their home.

THE CLAIMS PROCESS

We’re committed to serving our policyholders when disaster strikes and assisting you throughout the claims process.

STEP 1: Report your claim to us.

STEP 2: Tell us about your claim. Your claims professional will ask you for information about your loss, review and explain your policy coverage, including the deductible, and discuss next steps. If needed, they may schedule an in-person appointment or send an expert to your home, such as an engineer. Your claims professional will guide you through the claims process.

STEP 3: Your claims professional will evaluate the damages covered under your policy and provide you with an estimate.

STEP 4: After the evaluation has been completed, you will be advised of the coverage decision. Once your claim has been resolved, the file will be closed.

If you discover additional expenses or damages after your claim has been closed, or if you discover additional facts not previously presented regarding the loss, please contact us immediately to provide the information. At that time, your claim will be re-opened for additional review.

View the Homeowners Claims Bill of Rights.

YOUR SETTLEMENT

We will be working diligently to provide all policyholders with the attention they need and deserve, and have partnered with several adjusting companies to ensure we have the personnel to respond as quickly as possible.

It’s important to know that we respond to claims based on severity – our first priority will be to assist customers whose homes are uninhabitable to help them obtain safe shelter, food, and other basic needs. We appreciate your patience and understanding, and we’re committed to keeping you posted throughout the claims process.

Does your policy include Additional Living Expenses (ALE) coverage?

Additional Living Expenses (ALE) coverage reimburses you for the extra costs you incur when your home is deemed unlivable and is being restored. This coverage includes reasonable payments for lodging, food, clothing, and other associated expenses. It is disbursed immediately once approved. This is also referred to as loss of use coverage.

Know what to expect in the event of claim: Most of our policies include this coverage, but it’s important to speak to your agent or review your policy to be certain you have it. Make sure to keep all post-storm receipts to submit for reimbursement consideration.

AFTER THE STORM

Safety First: Make sure your family is safe. In the event that you need to vacate your home because it is unlivable, keep all of your receipts for temporary lodging and other expenses.

Make Temporary Repairs: If you can safely do so, take reasonable steps to protect your property from further damage, such as boarding up a broken window or tarping a roof. Take pictures of the damage and save all receipts for any purchases you need to make. Refrain from making permanent repairs until an adjuster has had a chance to assess the damage.

File Your Claim: American Integrity Insurance has a 24/7 claims hotline that’s dedicated exclusively to assisting customers impacted by a large, catastrophic event. Customers should call 844-MyAIIC1 to report their storm-related losses, or log-in to our Claims Portal to file a claim online and check the status of their claim. It’s important to note that, after a catastrophe, our claims response is based on damage severity – our immediate and primary goal is to provide assistance to customers whose homes are unlivable, and then we shift our resources to help all other customers whose homes were damaged by the storm.

Take Photographs of the Damage: This documentation can help expedite the claims process.

Make a List of Your Personal Property: Do you have a home inventory list? If not, create a list of the damaged items and include as much information as possible, such as model numbers, manufacturer's name, receipts, and photographs.

Emergency Cleanup: American Integrity Insurance recommends that our customers use a trusted network of preferred contractors for their post-loss home repair needs. These licensed and insured contractors undergo an in-depth credentialing process.

Claim Checks: If you have a mortgage on your home, payment for your home repairs will be in the form of a check made payable to you and your mortgage company. The mortgage company must endorse the check, so contact the company to find out their process for this situation.

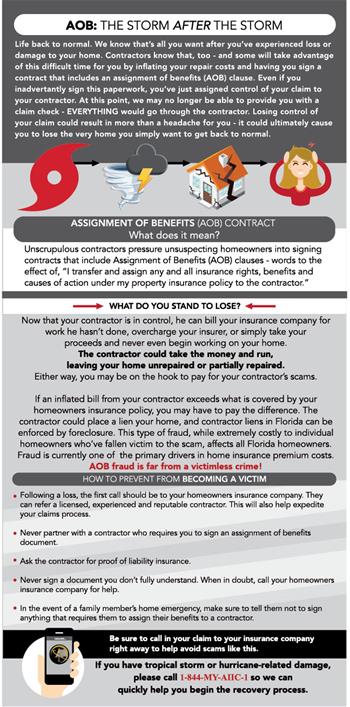

Be Aware of Post-Storm Scams: In addition to the damage they leave behind, storms like this have another unfortunate consequence – fraudulent contractors who take advantage of homeowners who are simply trying to get their lives and homes back to normal. Click the infographic below for details.

To avoid falling victim to a scam, we recommend using a network of preferred contractors who have completed a comprehensive credentialing process, ensuring contractors are licensed, carry the appropriate insurance and pass criminal background checks.

You are welcome, however, to hire a contractor of your choice.

Some good practices when selecting a contractor include asking around for recommended contractors in your area. Verify that they are licensed and insured, and check their work history.

Make sure to get all estimates for work in writing, and do not sign anything you do not understand. Be especially careful of contracts that include an “Assignment of Benefits” clause; by assigning your benefits to your contractor, you relinquish all control of your claim – a decision that could result in a contractor lien being placed against your home, which is enforceable by foreclosure.

DISASTER INFORMATION AND RESOURCES

Storm Tips & Resources

American Red Cross

Federal Emergency Management Agency (FEMA)

National Oceanic and Atmospheric Administration (NOAA)